TAN Application Form 49 B

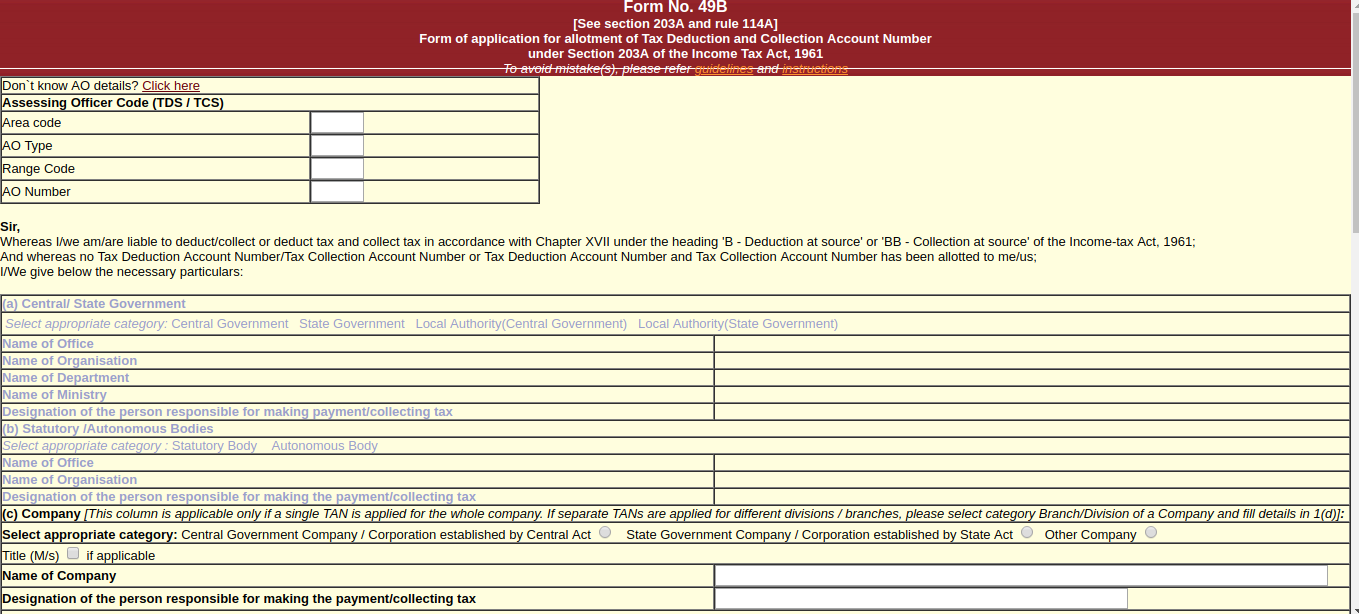

Form 49B, the TAN application form, facilitates the application process for obtaining a new Tax Deduction and Collection Number (TAN). This form is accessible through both physical visits to the Income Tax department office and online submission via the official Income Tax website.

Online Procedure for filing TAN Application:

Step 1

Go to the official website by using the link: www.tin-nsdl.com/index.html

Step 2

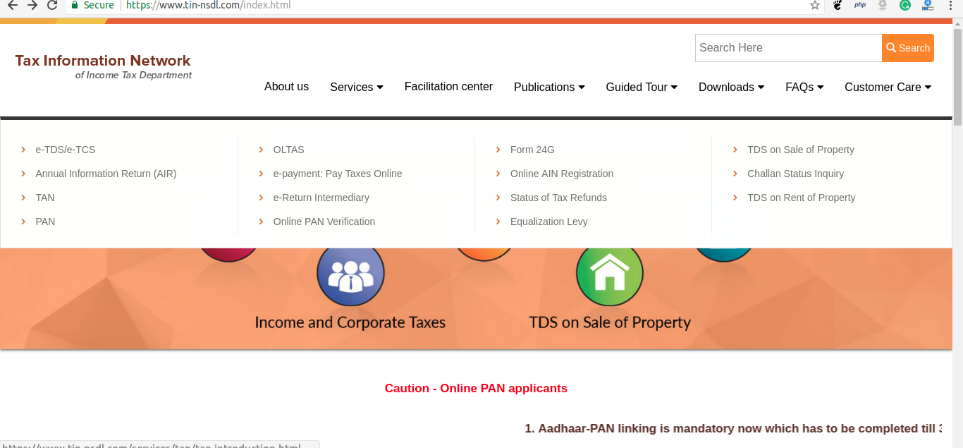

Make selection of option’ TAN’ under services dropdown.

Step 3

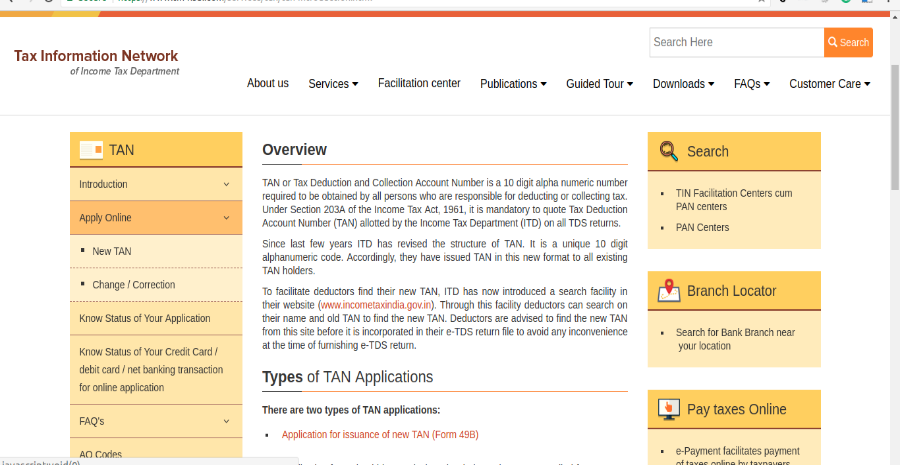

Click on apply online, choose option, ‘New TAN’

Step 4

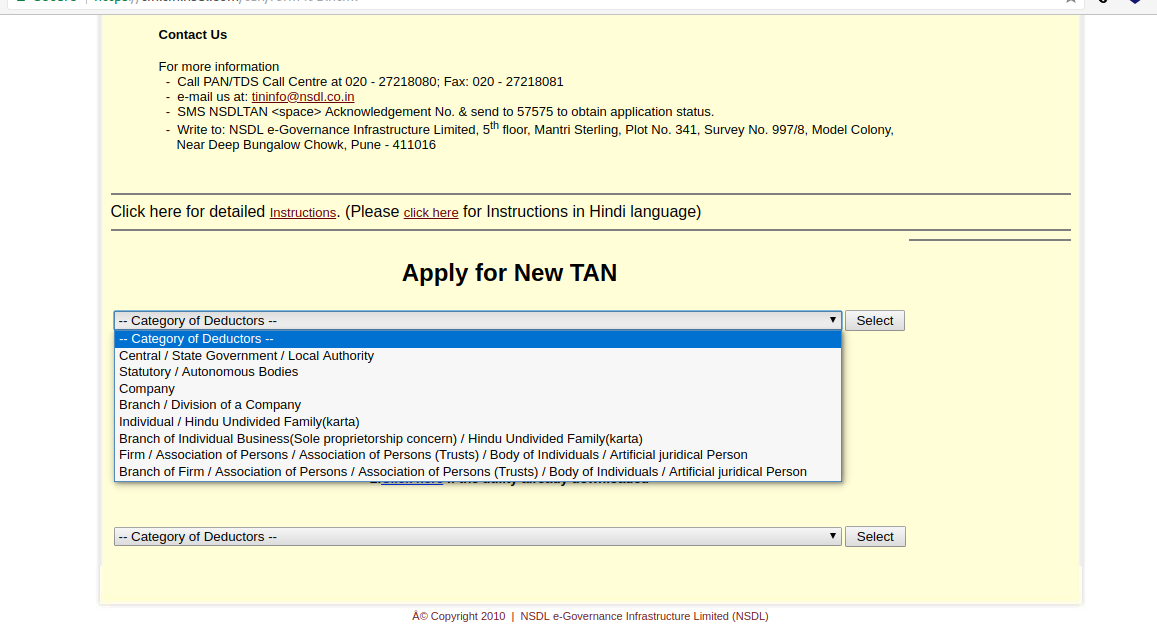

From the given list, choose from the list ‘category of deductors’

Step 5

Now, click on ‘Select’.

Step 6

After doing the so, you will be redirected to Form 49B.

Step 7

Next step is to fill in the Form 49 B and click on ‘Submit’.

Step 8

As soon as you click on the “Submit button”, an acknowledgment screen will be displayed which contains the following:

- 14-digit acknowledgment number

- Name of the applicant

- Status of the applicant

- Contact details

- Payment details

- Space for signature

Step 09

Now, you are required to save the acknowledgment and get a printout of it.

Step 10

Now, the printout of the acknowledgment along with other documents is required to be sent to NSDL at –

NSDL e-Governance Infrastructure Limited

5th floor, Mantri Sterling

Plot No.341, Survey No.997/98,

Model Colony

Near Deep Bungalow Chowk

Pune – 411016

Procedure to apply for TAN offline

Form 49 B can be downloaded from the official website of the Income Tax Department. One can also get Form 49B from TIN- facilitation Centers. One can take the address of TIN facilitation Center from the NSDL site https://www.tin-nsdl.com.

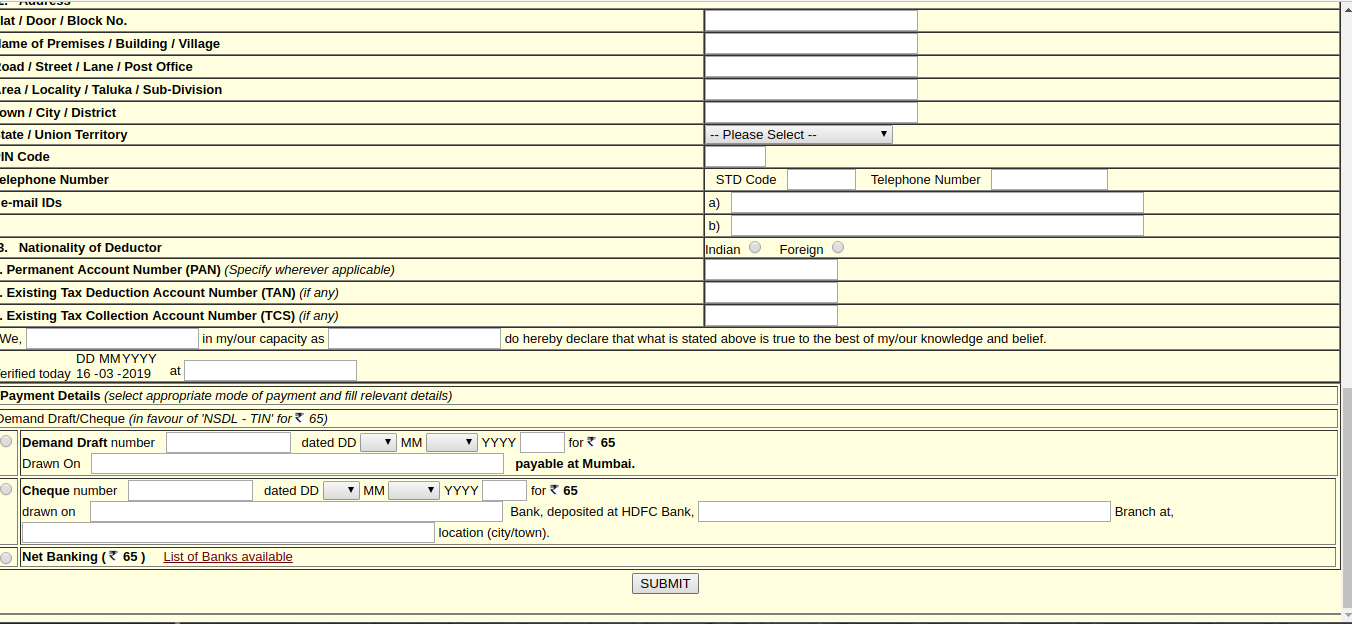

Documents require TAN Application

For offline, there is no need to submit any document. If the application is online, then an individual need to duly signed by the acknowledgment generated on successful submission and payment of processing fee towards TAN application. After that, acknowledgment needs to be sent to NSDL-TIN facilitation centers. The address will be available on the acknowledgment slip.

Important Points to Remember

- There is no need to do a separation of tax deduction/ collection account number for TDS deductions of property. Single TAN can be used for all kind of collections and deductions takes place in terms of commission, salary, property, etc.

- The category of TAN holders should remain in all transactions. The company’s TAN can be used for TDS deduction/deposit only if you are buying property in the company’s name. Please be assured to mention the correct TAN in all the necessary documents.

- Please keep in mind always that Form 49 B is to be filled only in English and in capital letters.

- At the time of filing form, there should be one letter in every text box for better clarity and readability.

- All details of the Assessing Officer need to be furnished by the collector or deductor of tax. One can accessed information from the Income Tax office; in case they are not available.

- Details related to area code, area, district, etc. must be mentioned by the tax, collector or deductor. The Income Tax office may be consulted to know details before filing Form 49B.

- In case the applicant is making use of the left-hand thumb impressions for signing the Form 49B, in that case, it should be duly signed and attested either by the Gazetted officer, magistrate or notary officer.

- Only those individuals who applied for TAN can put their Left thumb impression. Those who applied under the ‘Category of Deductors’ need to sign a printout of the acknowledgment slip

- Please fill up Form 49B completely without leaving blank or pending sections.

- A person must list down his or her designation who is responsible for filing and submission of tax.

- The address provided by the applicant needs to be an Indian.

- Once Form 49B is filled and submitted, the Income Tax Department does a verification of submitted details. If the information in the Form 49 B seems to be accurate, then NSDL will intimate all the new TAN details at the address indicated in the Form 49 B or if the application was made via online, email will be sent with TAN information.

Payment for availing TAN

To apply for new TAN, applicants are required to make payment. The fee for the process of TAN application is Rs 65 inclusive of 18% of Goods and Services Tax. Payment can be made using the following modes such as:

- Demand Draft

- Cheque

- Net banking

- Credit Card or Debit Card

If the payment is being made through Demand Draft, it should be drawn in favor of NSDL-TIN payable at Mumbai. It is must mention on the backside of the cheque, name and acknowledgment number and after that please sent it to NSDL office along with acknowledgment slip.

In case, payment made through cheque, the applicant is required to deposit a local cheque of any branch with the HDFC branch across the country except for Dahej Branch. While depositing the cheque, the applicant is making the payment must mention ‘TANNDSL’ on the deposit slip.

Payment made through Debit Card or Credit Card or Net banking facilities are not available for applicants who fall under the below-mentioned category:

- Central Government or State Government

- Autonomous or Statutory Bodies

Those who are authorized to make Debit Card/ Credit Card or Net banking payment

| Category of the Applicant | Authorized person whose credit card/debit card/net banking can be used for making the payment |

|---|---|

| Company/Branch /Division of a Company | Any Director of the Company |

| Individual (Sole Proprietorship)/Branch of individual | Self |

| Hindu Undivided Family | Karta |

| Firm/ Branch of the Firm | Any Partner of firm |

| Association of Persons/Body of Individuals/ Association of Persons (Trusts)/Artificial Juridical Person | Authorized signatory covered under section 140 of Income Tax Act, 1961 |

Benefits of TAN registration

- Deductor can easily receive communication regarding Tax collected at source (TCS) and Tax Deducted at Source (TDS) from the database of updated active TAN details. This information is given by the Income Tax Department.

- There is an authenticated login area for every deductor.

- There are also provisions and benefits to download the latest input file (FVU) to prepare a correction statement and check the status of Challan online.

- The deductor can receive a statement showing the status of Tax Deducted at Source (TDS).

- Deductor can easily do the uploading of e-TDS returns online.

- Reconciliation of Tax Deducted at Source (TDS) to TAN holder with regards to Section 200A.

- With the help of a TAN number, the process of registration and verification becomes quite simpler.