Pan Card Jurisdiction

A Permanent Account Number (PAN) is a distinctive 10-digit alphanumeric code assigned to each holder, establishing a unique identity. Each PAN cardholder is associated with an Assessing Officer. The Assessing code delineates the PAN jurisdiction, including commissioner charge circle/ward.

Numerous websites offer details regarding the jurisdiction of a PAN based on the PAN number of an individual. The PAN Card jurisdiction feature on the official website furnishes comprehensive jurisdiction details upon entering the PAN number.

Need of PAN Jurisdiction

PAN jurisdiction offers full-fledged details of the

- Commissioner charge,

- Chief commissioner region

- Joint commissioner range

- Place and designation of Assessing officer

For instance, if an individual applies for a PAN card and is being allotted by the Income Tax Department based on permanent address which is mentioned in the PAN application form, they can also check the PAN card status.

In case, if an individual wants to change their permanent address and want to communicate same to the IT Department on this change, then in that case individual also needs to change his or her PAN jurisdiction. It lies with the jurisdictional Assessing officer.

With the help of PAN jurisdiction, you can change or shift your permanent address easily. Individuals by visiting on the website of the Income Tax Department get to know your PAN easily.

STEPS TO KNOW YOUR PAN JURISDICTION

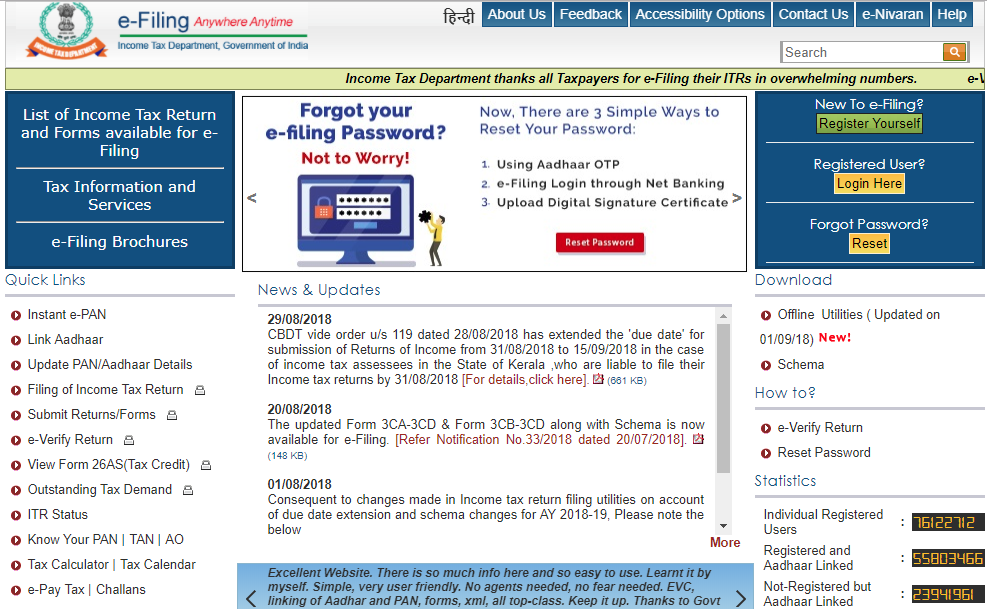

Visit the official website of Income Tax at https://www.incometaxindiaefiling.gov.in/home

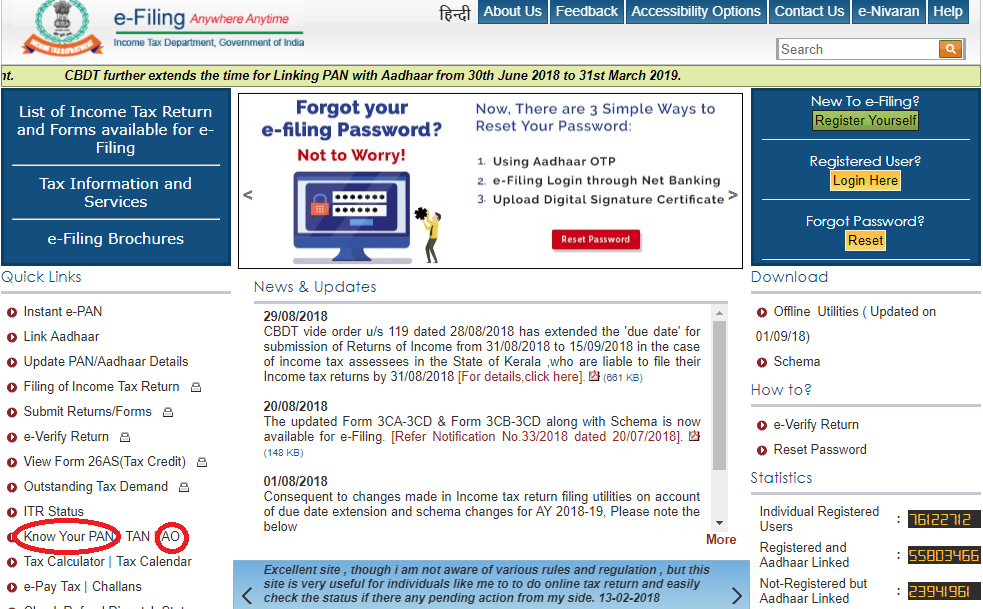

Select “Know Your PAN/TAN/AO”

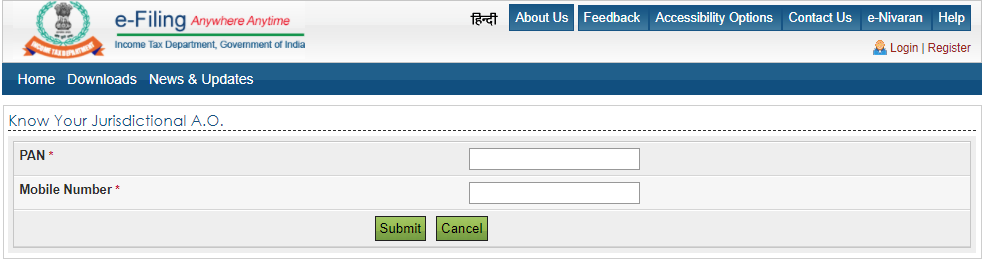

Enter “PAN Number” and “Mobile Number” and then click “Submit’’

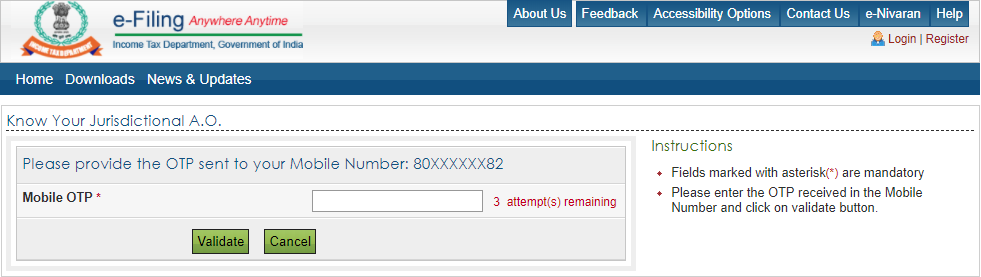

Enter the OTP received on your registered mobile number and click “Submit”

PAN jurisdictional details will be displayed on the screen for the concerned PAN number.

Why people want to change their PAN Jurisdiction?

- When they are planning to shift or change their residential address.

- When the individuals are not satisfied with Assessing officer of their jurisdiction area.

Steps by which taxpayers can change their Assessing Officer when changing their address

Step 1: Visit the official website of NSDL at https://www.tin-nsdl.com

Step 2: Click on “PAN” under ‘Services’ section

Step 3: Click “Apply” under “Changes/Correction in PAN Data”

Step 4: Fill up the required details carefully along with the necessary documents

Step 5: You will be redirected to the payment gateway page. Pay the required amount and submit

Step 6: You will be provided new PAN card with the new Assessing Officer code with 15 days of the form submission.

Process of changing of Assessing Officer due to unsatisfactory behavior

- Write a detailed letter and sent to authorized representative.

- Get clear details such as address, name and name of your Assessing officer along with reason of being not satisfied with the work.

- Both Assessing officer and Applicant are required to sign on the letter.

- Furnish relevant supporting documents along with the letter.