Link PAN Card with EPF Account

The Employees Provident Fund Organization (EPFO) has simplified the process of linking PAN Card with an EPF account. Updating KYC details is mandatory to facilitate online claims in EPF. PAN holds significance as a crucial document for tax savings on EPF withdrawals. According to the latest regulations, TDS deduction applies to EPF withdrawals if the cumulative service period is less than 5 years. If PAN is already linked to the EPF account, the TDS deduction rate is 10%; otherwise, it can go up to 34.608% for non-linking of PAN card with the EPF account.

No TDS will be deducted if the EPF balance is below 50,000. The online process for linking PAN card with EPF is as follows:

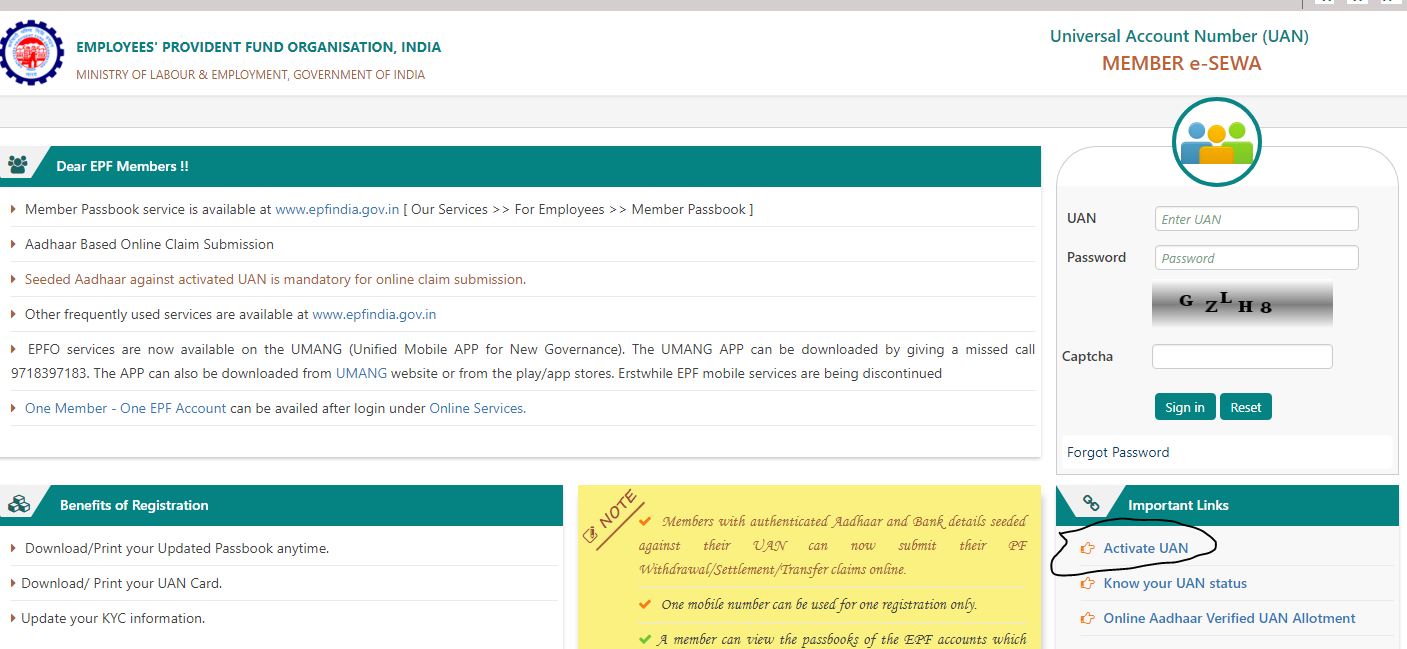

Step 1

By logging to the website of EPF members portal using your User ID that is UAN number and password at the https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

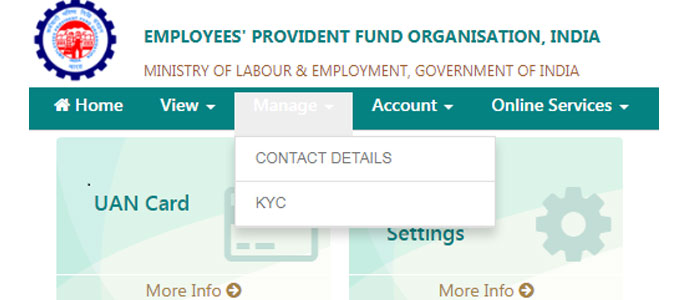

Step 2

Click on the option of ‘KYC’ in the dropdown ‘Manage’

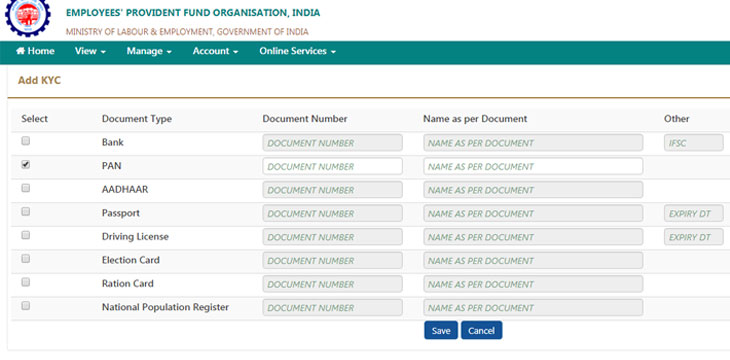

Step 3

Select the ‘PAN’ option and enter all the PAN Details. Apart from PAN, you can also update other KYC details such as Aadhar, Bank Account, driving license, Passport, Election Card, Ration Card etc. at the time of providing PAN details.

Step 4

Now click on ‘Save’ button and submit the documents for the verification process.

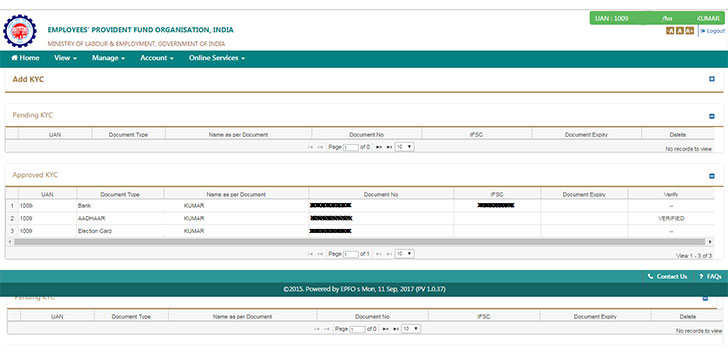

Step 5

After you have saved all the details, verification of PAN will be done by NSDL.

Step 6

After getting approval on KYC document, PAN will be linked with your EPF Account. You will find ‘Verified’ written against the PAN details.