Link PAN Card with Aadhar Online

To link PAN and Aadhar online, there are primarily two methods:

- Utilizing the Income E-filing website.

- Sending an SMS to either 567678 or 56161.

Process of linking PAN with Aadhar card online

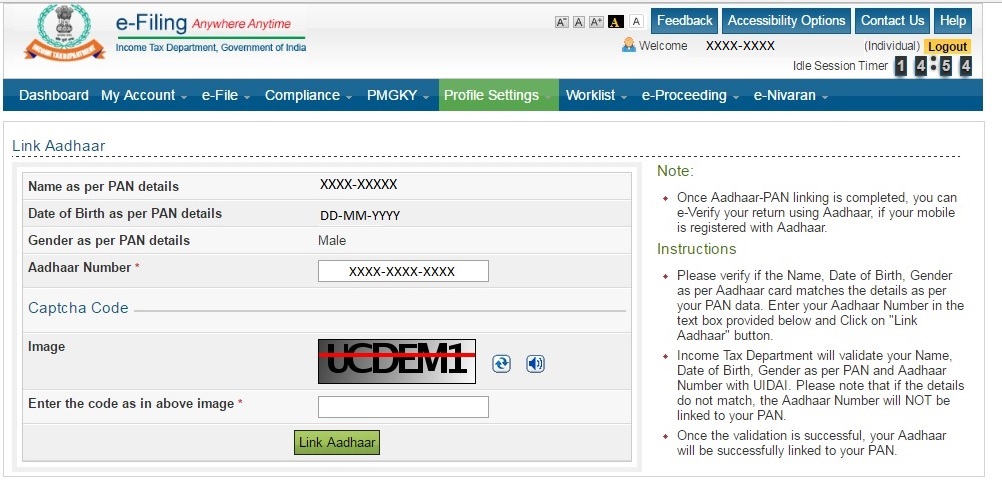

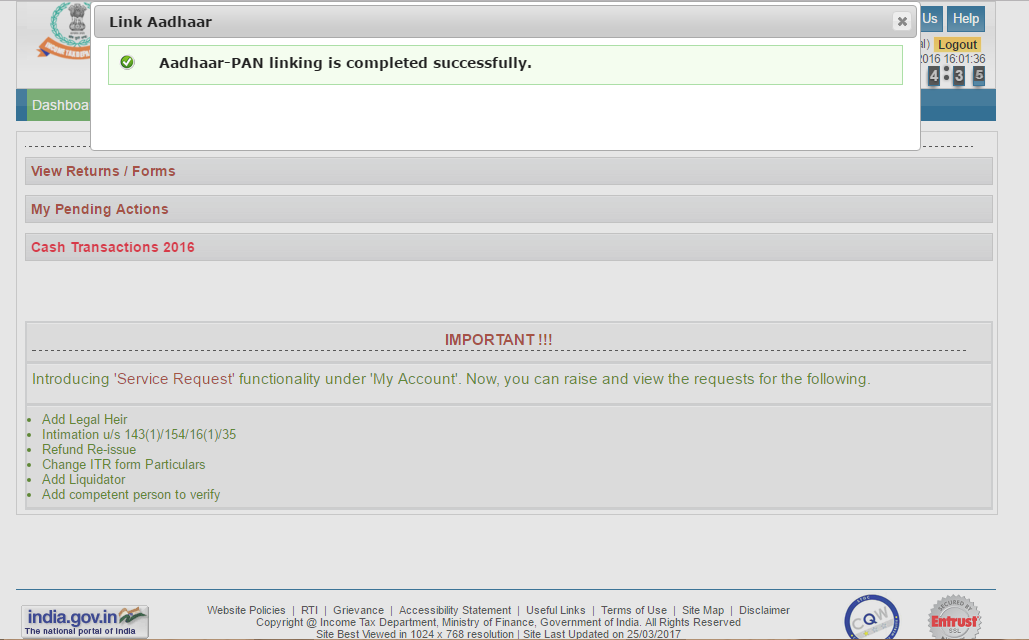

- Log on to the Income Tax Website.

- Provide details regarding PAN Number, Aadhar number and name as per Aadhar card.

- Tick the square, if only the year of birth is mentioned in the Aadhar card.

- Enter the Captcha code (users who are visually challenged can request for an OTP). The OTP will be sent to registered mobile number.

- Click on ‘Link Aadhar’ button.

How to link PAN and Aadhar via SMS?

- Another way of linking PAN with Aadhar is by sending SMS to 567678 or 56161 with registered mobile number. In order to do so, you need to type UIDPAN(12-digit Aadhaar)(10-digit PAN) and send it.

- If your Aadhaar number is 987654321012 and your PAN is ABCDE1234F, you need to type UIDPAN 987654321012 ABCDE1234F and send the message to either 567678 or 56161.

Correction facility for linking PAN and Aadhar Card

It is must that when you link PAN Card and Aadhar Card, both details must match. In case of any errors in spelling mistakes in your name, your PAN will not be able to link with Aadhar Card. One can make changes by log on the UIDAI website or on the portal of NSDL.

Steps to make correction are as follows:

Correction VIA NSDL

- User can make correction in or his PAN details by using of NSDL website.

- NSDL link redirects to the page where one can apply for name correction.

- Submit the signed digital documents for the purpose of updating PAN details.

- Once the correction made in PAN and confirmed by NSDL via email, then it becomes easier to link PAN Card with Aadhar Card.

Correction via UIDAI

- It is a very simple process to make correction. By visiting the UIDAI webpage, by clicking https://uidai.gov.in/my-aadhaar and enter your Aadhaar and security code.

- An OTP will be sent to your registered mobile number.

- In case you are looking for changes in the spelling of your name, only OTP is required.

- In case are looking for modification in other details such as gender and date of birth, you must send the supporting documents along with the same.

- Once approved, the user can link his PAN card with Aadhaar.

Finance Minister proposed of making use of Aadhar Card for filing taxes, PAN card is not a compulsion

- At the time of Union Budget 2019, Finance Minister, Nirmala Sitharaman put a proposal of allowing people to use the Aadhar Card for filing taxes in India.

- Earlier, only PAN card issued by the Income Tax department, Finance Minister pointed out that now more than 120 Crore Indians have Aadhar Card. With this, proposal came that Aadhaar card and PAN card be interchangeable to file for taxes for the citizens who do not have a PAN card.

- The process of filing Income Tax return will be same as only change is adding of the Aadhar number instead of using PAN whenever there is a requirement.

New rules of PAN Card and Aadhar Card

Union Budget 2019 comes up with lots of changes with respect to Aadhar Card and PAN Card

- Use of Aadhar card in transactions above Rs 50,000 in place of PAN Card is also allowed in all banks and other institutions. So now all banks and other institutions must upgrade system to accept Aadhar details for transactions which required PAN Details previously.

- Cash deposits and withdrawal: One can make use of the Aadhar details to withdraw or deposit amount up to 50,000.

- Aadhar- PAN Linking: Those who file Income Tax return by using their Aadhar Card will be allocated a new PAN by their tax authorities.

- ITR Filing with Aadhar: Your Income Tax returns can be filed with your Aadhar even if there is no PAN Card.

- PAN will not be determined without linking of Aadhar Card: Since people now get an option of using PAN card details or Aadhar Card details both, in case no linking of PAN with Aadhar, in that case PAN Card details will not be determined.

- There are a few cases where these details cannot be interchangeable used though. This includes cash transactions made at hotels or for foreign travel bills (transactions need to be over Rs.50,000). Moreover, you will require PAN card details if you wish to purchase immovable property whose worth is greater than Rs.10 lakh.

Importance of linking PAN Card and Aadhar Card

Both Aadhar Card and PAN Card are considered as a unique identification card. Both serve as identity proof at the time of doing registration or verification. The Government made an urge to all the entities for linking their Aadhar Card and PAN Card.

- Prevent from Tax evasion: By linking PAN Card and Aadhar Card, government can keep a watch on the financial or taxable transactions of an individual entity. It means that every transaction or an activity which is taxable will be easily recorded by the government.

- Multiple PAN Cards: Another reason for linking Aadhar Card and PAN Card is to reduce the occurrence of entities applying for multiple PAN Cards which results into the case of defraud the government. When an individual or entity holds multiple PAN Cards, then entity can make use of one of the cards in certain set of financial transactions and other PAN card can be used for another transactions. With holding multiple PAN cards, he or she creates a way to avoid paying tax.

- Correction facility for linking Aadhar Card and PAN Card launches by Income Tax Department Income Tax Department started an online facility for doing corrections in names and other information available on PAN Card and Aadhar document. Now there are two hyperlinks present on the official website of e-filing of tax. One link takes to the application page of PAN and other link takes you to the page where one can update all the necessary changes. To do an update of all the Aadhar details, individual can log on to Aadhaar SSUP (Self Service Update Portal where one can also upload all the scanned documents that are needed as data update request proof.

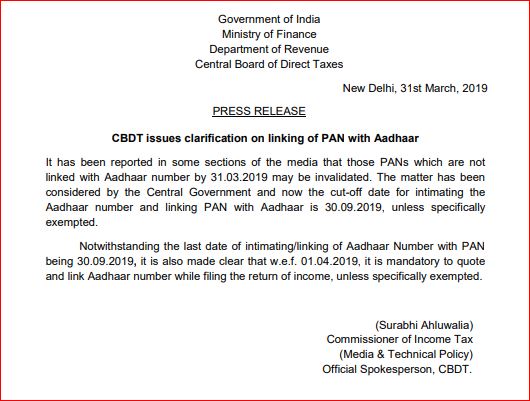

Deadline for linking PAN Card and Aadhar Card is September 30